Single payment’s parameters

Only single payment details will be covered in this section.

Provide all required parameters in the request:

|

Parameter |

Description |

Mandatory? |

|

merchant.brandId |

For single merchants - Your identificator - BrandId - will be provided by your Account Manager For baas partners - BrandID value from Get clients API response. |

Yes |

|

merchant.generic1 |

This information will be passed back in the response. |

No |

|

merchant.generic2 |

This information will be passed back in the response. |

No |

|

merchant.generic3 |

This information will be passed back in the response. |

No |

|

merchant.redirectUrl |

URL where to redirect Consumer after payment authorization. We support only TLS encrypted connections (URL must begin with https://, not http://). Hostname will be validated against URLs you provided us. |

Yes |

|

merchant.notificationUrl |

URL where notifications about the payment should be sent. We support only TLS encrypted connections (URL must begin with https://, not http://). Hostname will be validated against URLs you provided us. |

No |

|

merchant.language |

Allows to specify Widget UI language. If parameter not provided, defaults to EN. Currently supported languages: EN, DE, NL, FI, SV, LT. |

No |

|

payment.paymentMethod |

PIS – for payment initiation, CARD - for card payments. If provided both, e.g. [“PIS, "CARD"] then one additional step added - payment method selection in our widget. We strongly recommend choosing a payment method from checkout. |

Yes |

|

payment.providerCountryCode |

Used to preselect country when requesting to initiate payment. Available countries for bank transfers: DE, NL, FI, LT For card payments use any country value (soon to be retired for card payments) |

Yes |

|

payment.providerId |

Allows you to preselect provider for bank transfers when requesting to initiate payment. This way you can skip our widget part and redirect your customer to preselected bank. Important! When using preselected provider, you must ensure our Terms of Use and Privacy Policy visible for your customer before initiating a payment. You can find the text here. |

No |

|

payment.debtorAccount.iban |

IBAN from which the payment should be performed |

No |

|

payment.debtorName |

Name of debtor account holder |

No |

|

payment.instructedAmount.amount |

Requested amount, with 2 decimal digits |

Yes |

|

payment.instructedAmount.currency |

Only EUR supported. |

Yes |

|

payment.remittanceInformationUnstructured |

Payment details, up to 80 characters. For better customer buying experience we strongly recommend adding order or invoice number. |

Yes |

|

identifiers.merchantReference |

Unique payment reference in your system |

Yes |

|

identifiers.endToEndId |

End to End identifier in accordance with ISO20022 specification (1 to 35 symbols). Will be passed to the Consumer's Provider |

Yes |

|

identifiers.creditorReference |

Creditor Reference according to ISO 11649 (/^RF[0-9]{2}[0-9A-Za-z]{1,21}/). |

No |

|

identifiers.finnishReference |

Finnish reference number (/^\\d{4,20}$/) |

No |

|

identifiers.norwegianKid |

Norwegian KID reference number (/^\\d{3,25}$/) |

No |

|

consumer.firstName |

Consumer‘s first name. For business entities you can use company type (e.g. PLC) |

Yes |

|

consumer.lastName |

Consumer‘s last (family) name. For business entities you can use company name. |

Yes |

|

consumer.consumerId |

Your internal Consumer ID, if you have it |

No |

|

consumer.ipAddress |

IP address of Consumer's device |

Yes |

|

consumer.phoneNo |

Consumer's Phone Number. Providing it would help to make Consumer's user experience smoother. |

No |

|

consumer.email |

Consumer's email. Providing it would help to make Consumer's user experience smoother (if not provided, we will collect email through payment widget) |

No |

Hostname in merchant.redirectUrl and merchant.notificationUrl will be validated against URLs provided to us.

In Payment initiation response, you will receive Merchant API paymentOrderNo and redirectUrl, where should forward Consumer to start authorizartion flow.

With paymentOrderNo you will be able to request Payment details via Get Payment Details API.

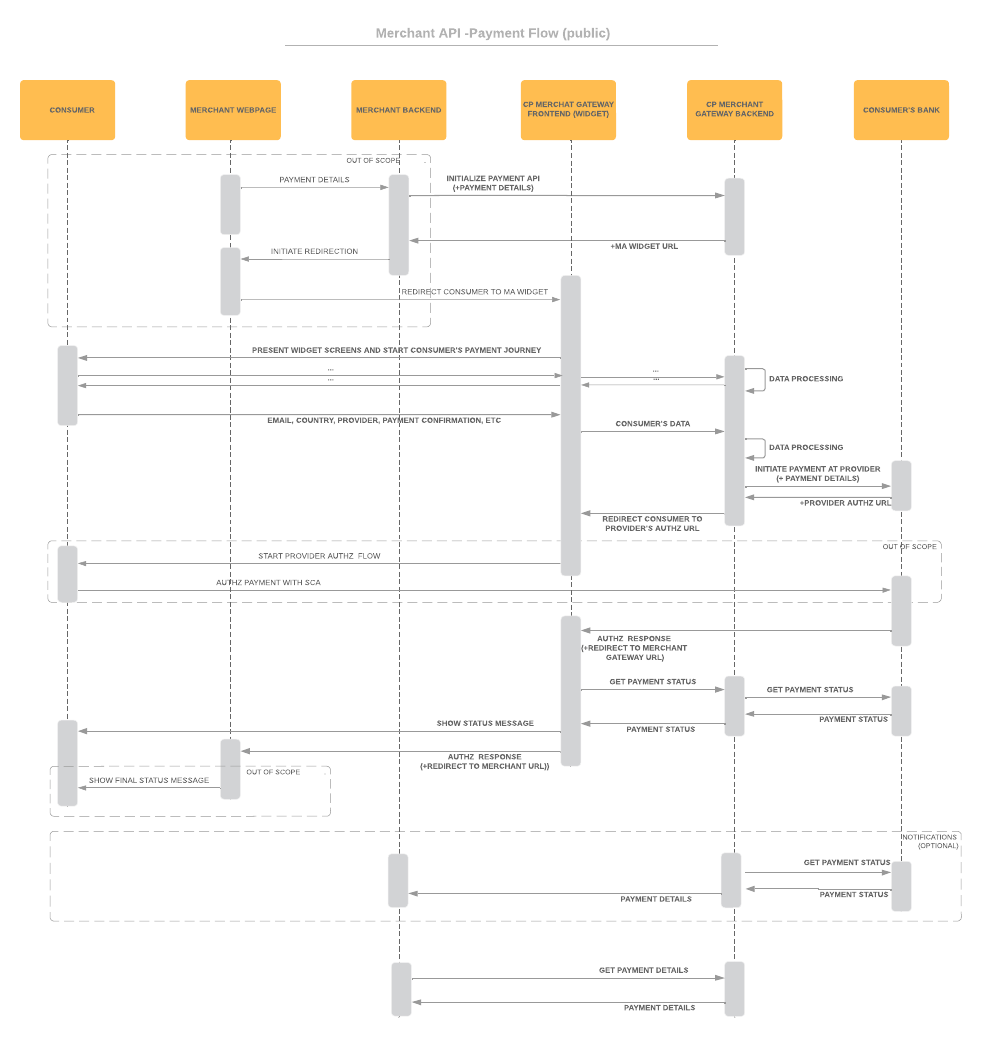

Payment flow

1. Initiate a payment

To accept a payment for your customer, at first you need to initiate a payment using our Initiate payment API as provided in example below:

A. If you are a single merchant, use this PATH: /merchant/payments and authorization requirements provided here.

B. If you are a platform using BaaS APIs, use this PATH: baas/merchant/payments and authorization requirements provided here.

POST /merchant/payments HTTP/1.1

Host: api2-stage.connectpay.com

X-Request-ID: 7b5e3498-a926-4fae-89a6-381eca510d6a

Accept: application/json;version=2

Content-Type: application/json

X-Signature: kQFANf/z8qjgHyEfFOLPITjgYeQKjT4ksOJcOOJ7CcqEn6WXEw8exuL8yt+BUWMKoGFFt9wrL5X69ELVSXhp/ARodqmx/zyG/NfyCcqZ+SLX31h0jHWGH/u+IQtQXKt5x46PR/Yi7gCebqhrZXIt8au7duvFZB/ZNr/0YDsW0ciMzDsPsDl9dJcAyTIqa4B29rbyM+Svd6SMzlvqIDo4gH0BBX9aNYshrD9/eSFtGb3iysfU412UBzKqwYRiFK5tp84XwKKxai/ktuPW+gFQbF8U/fo5HQMYTUQ8+FeoIUfIEr1dReIVZZmcBI5Ncnpme1WYUXoViT9tdC+B8Z6Sow==

Authorization: Basic NTQxOThmNTItN2Q5Mi0zZjk4LTk5ZmEtOTE5OTE2NWEzZDQ3OjdmMGVhYjExLWVjZDEtM2UwZi05OTgzLWQ3OWIwNjYyYTZkYw==

{

"merchant": {

"brandId": "6ce66290-71a3-4376-be87-77f16cf6fe19",

"generic1": "B2C",

"generic2": "ROI",

"generic3": "grow",

"redirectUrl": "https://localhost",

"notificationUrl": "https://localhost",

"language": "EN"

},

"payment": {

"paymentMethod": ["PIS"],

"providerCountryCode": "NL",

"providerId": "03a4effd-d047-4c3e-ab95-1b4fb198b64f",

"debtorName": "Turcotte, Reichel and Rau",

"instructedAmount": {

"amount": "1.23",

"currency": "EUR"

},

"remittanceInformationUnstructured": "Secured homogeneous structure"

},

"identifiers": {

"merchantReference": "10438ba4-c180-44be-9306-3760d2ab00d0",

"endToEndId": "3fZcjUEGynfXhs8JcsiGpXzRpowMe",

"creditorReference": "RF12334567"

},

"consumer": {

"firstName": "Morton",

"lastName": "Heidenreich",

"consumerId": "d48c0a1b-d1b0-49f9-8851-a4bea951ed2b",

"ipAddress": "56.192.2.34",

"phoneNo": "37066666666",

"email": "Trycia69@gmail.com"

}

}

If request was successful, you will receive response with http code 201 and payment ID and redirect URL in response body. You have to redirect your customer to redirtect URL to authorize a payment within their provider (bank). Save payment ID for further status check. Response example below:

{

"merchant": {

"generic1": "B2C",

"generic2": "ROI",

"generic3": "grow"

},

"payment": {

"paymentOrderNo": "af8065f3-88da-4fad-b1d6-556667fe8284",

"redirectUrl": "https://pay-stage.connectpay.com?key=2a65b7db-5645-4807-bc59-a65e15a5dce0"

}

}

2. Redirect Consumer to Merchant API Widget

3. Redirect Consumer back to your environment

After authorization within their bank, Consumer will be redirected back to widget and will be presented with payment status information.

Sometimes, provider may not respond immediately with the final payment status information. In such cases, we will periodically check at Provider for final status and update payment information. Same way, you should periodically check payment status using Get payment details API .

As a final step of payment journey, by pressing button Return to Merchant, Consumer will be redirected back to your website using web address provided via redirectUrl parameter in Payment Initiation API request.